Axis Bank’s Young Bankers Program

Axis Bank’s Young Bankers Program is a unique initiative to groom young graduates to kickstart a successful career in banking.

The Young Bankers program is co-created by Axis Bank in partnership with Manipal Global Education Services. It has been very well received over the last 11 years with close to 11000 successful Young Bankers being trained and inducted in Axis Bank.

On successful completion of the program, the participant will be awarded with a Post Graduate Diploma in Banking Services from Manipal Academy of Higher Education (MAHE)- an Institution of Eminence.

The one-year program moulds young graduates into new age bankers with adequate domain knowledge, skills & attitude required to have a successful career in the banking sector.

Program Features

Course Structure

4 months Campus training

- E-learning modules

- Model branch simulations

- Power talk by Axis leaders

- Case studies

- Group presentation

- Volunteering activities

- Classroom lectures

- Assignments

- Talks by experts from industry

- Field visits

- Role plays

- Finacle training

3 months Internship

- Learning through observation & shadowing

- Structured internship diary

- Hand holding at branches

- Mentorship by Manipal faculties

5 months On the job training

- Team support

- Mentoring by seniors

- Business Goals to help align to business expectations

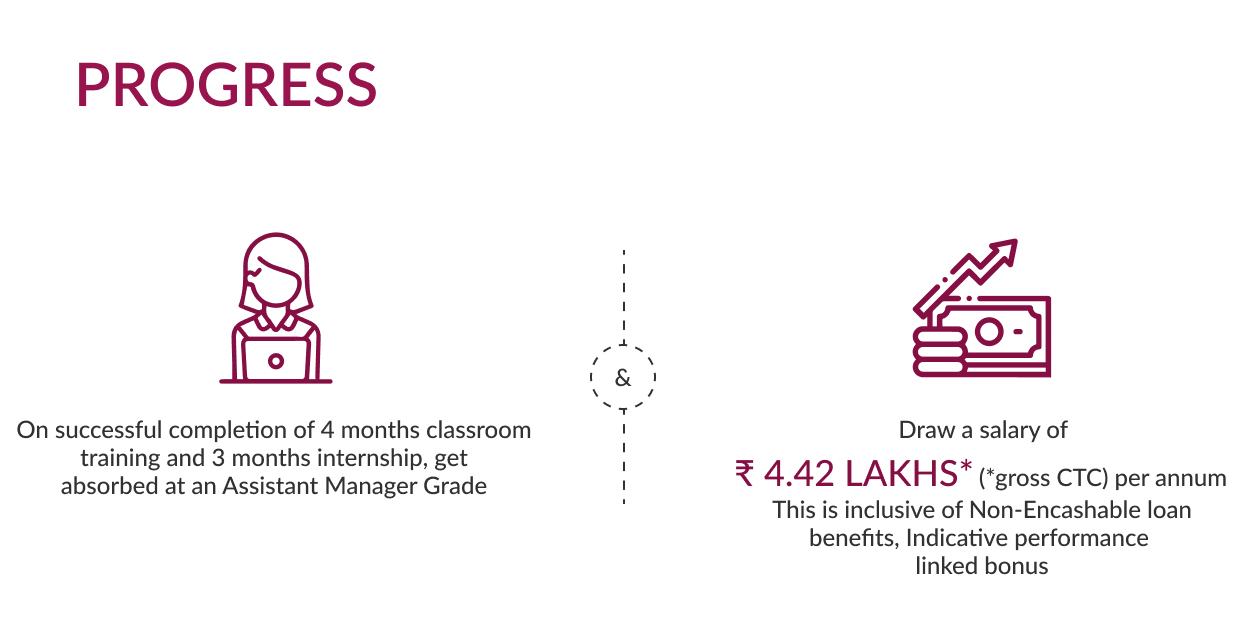

On successful completion of the first 7 months duration, the candidate gets absorbed at Axis Bank as Assistant manager

On successful completion of the program, the candidate is awarded with a Post Graduate Diploma in Banking Services from MAHE.

Learning outcomes

Customer Orientation

and sales mindset

- Develop sales skills

- Acquire, deepen and retain customer for long lasting customer relationship

- Engage for productivity

- Achieve business targets

- Demonstrate excellence by offering timely and effective solutions

Domain expertise

- Build first day, first hours on the job productivity

- Gain understanding on banking

- Gain critical awareness of current challenges and new trends in banking industry

Professionalism

- Align to organizational culture and values

- Align to role and business expectations

- Communicate effectively in business situations

Axis Bank Young Banker’s Program - ABYBP

This is a One-year program specifically designed for Axis Bank. The program has been on-going for over 11 years since 2012. In the last 11 years, over 11000 students have been inducted into Axis Bank Ltd through this program.

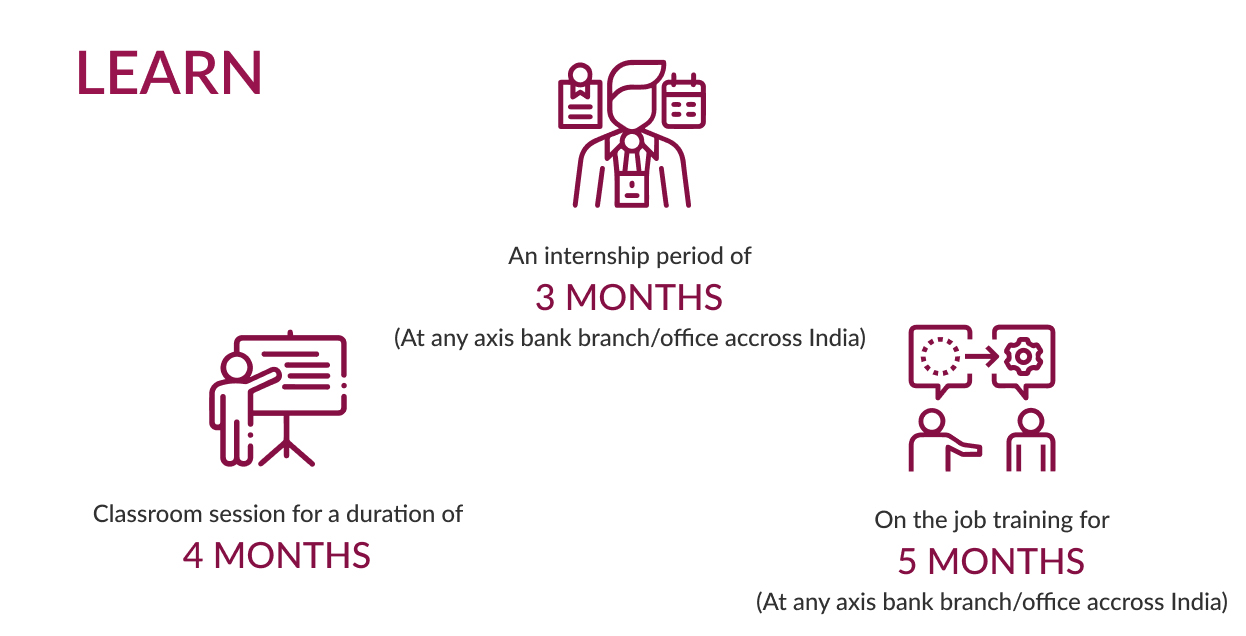

As a part of this One-year program, the selected candidates will undergo:

- 4 months of classroom learning (at Manipal Academy of BFSI, Bengaluru)

- 3 months of internship with Axis Bank at any of the bank branches / offices PAN India.

- 5 months of On-The-Job Training with Axis Bank (where candidates will undertake a full-time role) at any of the bank branches / offices PAN India.

The Banking program is built around essential functional and banking related subjects with a firm focus on experiential and application-based learning as well as overall personality development to become a thorough Banking professional. The program is designed to align the Young Banker to the designated Role and the Axis way of functioning. The program aims at making the Young Banker First Day First Hour ready for the job.

Qualification:

- Graduates with aggregate of 50% and above in all semesters of Graduation.

- Candidates in the Final Year of their Graduation/Post Graduation who have appeared for their examination & are awaiting results are also eligible for the program. However, Original Final Year mark sheet & degree certificate will have to be submitted on joining the academy.

- Graduation Degree (10+2+3 patterns ) is compulsory

You would NOT be eligible for this program if:

- You have a relative working at Axis Bank in accordance to the relative hiring policy of the Bank. Moreover, if two relatives get selected for the program, candidate with lower assessment score will have to withdraw their application

- You have been subjected to any disciplinary proceedings by your previous employer(s) at any time

- You have ever been proceeded against or convicted under any criminal statutes or in a consumer forum

- Any legal action is pending or proposed to be initiated against you

- You are not eligible if your age is more than 35 years

Disclaimer:

- Before applying, the candidate should ensure that he/she fulfils the eligibility and other norms mentioned.

- In case, it is detected at any stage of the selection that a candidate does not fulfil the eligibility norms and/or that he/she has furnished any incorrect/false information/certificate/documents or has suppressed any material fact(s), his/her candidature will stand cancelled. If any of these shortcoming/s is/are detected even after admission / appointment, his/ her admission / services are liable to be terminated.

- In case, you have worked previously with Axis Bank, and if basis rehire policy of the bank, you are not found eligible to be rehired via this program, then bank will cancel your application in accordance to the rehire policy of the Bank.

- Decision of the Bank in all matters regarding eligibility of the candidate, the stages at which such scrutiny of eligibility is to be undertaken, the documents to be produced for the purpose at the time of conduct of examination, interview, selection and any other matter relating to recruitment will be final and binding on the candidate. No correspondence or personal enquiries will be entertained by the bank in this behalf.

NOTE: Shortlisting at any stage during the application or selection process will be done basis bank’s criteria. The student's education qualifications and background will be verified by the Bank through an external agency. The details provided by the student at the time of application/selection need to be authentic which are subject to verification. Once the Agency confirms the authenticity of these details only then the candidate will be considered for further process of selection/ employment in the Bank. At the time of joining the bank, the candidate will have to submit a “self declaration” medical fitness form.

- Graduates or Postgraduates from any stream

- Fresher or Individuals with work experience looking for a career in Axis Bank

- Individuals interested in joining a Job Oriented Program

STEP 1: Register yourself by completing your online application form on this site. Please note, your application will be considered for further processing only when it is completed, including the payment of application fee. This application fee is for the purpose of the assessments and does not guarantee selection for the Young Bankers program or employment with Axis Bank.

STEP 2: The selection process consists of 2-stages of proctored Online Assessments

- Level 1/ Written Test : Verbal Ability, Analytical Ability, Numerical Ability, Written English Test, Listening Comprehension Test

- Level 2/ Video Interview : Online AI Video Assessment

STEP 3:

- The selected candidates will be issued an admission letter. On completion of the admission formalities, the selected candidates shall be enrolled in campus.

Mention any ONE of the following for Address/ID proof

Address Proof/Identity Proof/Signature Proof

- Passport

- Driving License

- VOters Identity Card

- NREGA Card

Birth Date Proof (Any 1 document)

- Passport

- Driving License

- Birth Certificate

- School Leaving Certificate

- SSC/HSC Certificate

- Election Card/Voter Card

ID Required

- PAN Card (Mandatory)

- Aadhaar Card issued by UIDAI (Mandatory)

Academic Certificates (All Original Documents)

- 10th SSC & 12th HSC Mark sheets

- Graduation Certificate, Mark Sheet

Selection Process

.01

Register yourself by completing your online application form

.02

Pay application fee

.03

Take online Assessments

.04

Selection & Issuing of admission letters

Why ABYB

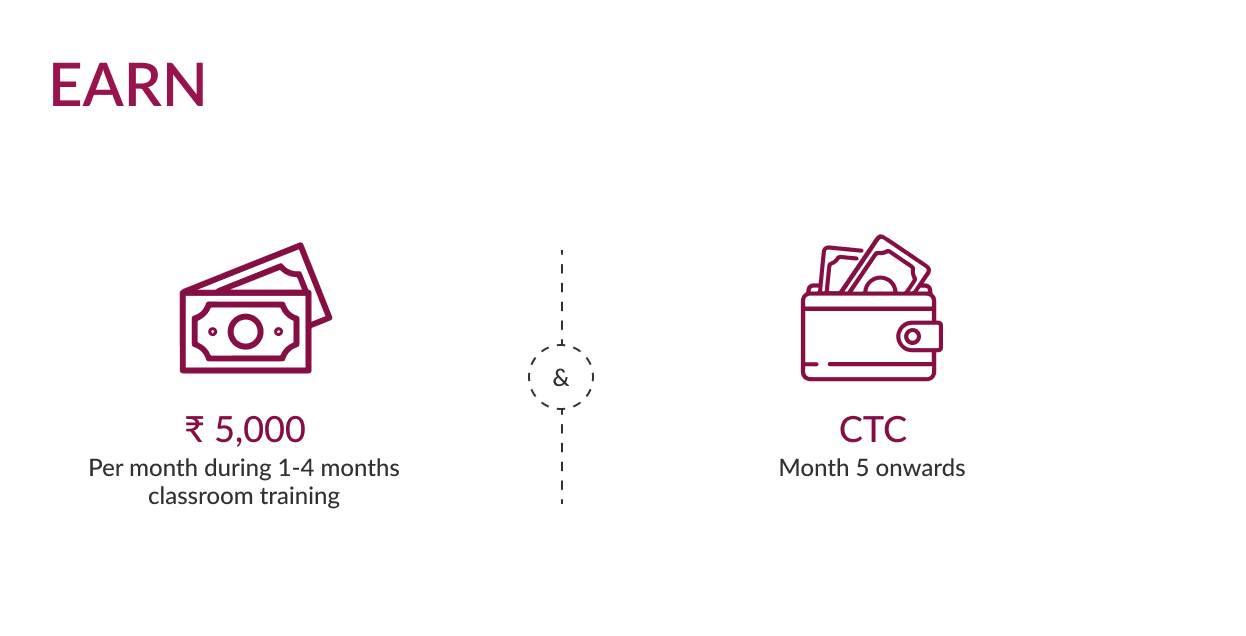

- Axis Bank’s Young bankers program is a 1-year course which offers Stipend during the course.

- Young Bankers program has a work oriented course structure with practical inputs that makes your learning journey enriching

- One of the outcomes of successfully completing the Young Bankers program is a job placement opportunity with Axis Bank

- Young Bankers Program equips you with the required skill sets and knowledge for a seamless transition from campus to corporate

Testimonials from our Alumni

“In my initial years at Axis Bank, I was part of one of the larger branches. In my role, handling clearing of a volume of around 800 cheques was a challenging task. However, I learnt a lot from the operations head and the branch head and they were my mentors. Axis is my first job and my journey with Axis has taught me perseverance and has helped develop my leadership skills.”

- Young banker from batch 08 - Joined in 2016 - Promoted to Deputy Manager in 2018 and to Manager in 2020

“My first posting was at one of the largest branches in India. In my role then, I got to handle critical and sensitive areas. The diversity of work in the branch gave a boost to my Axis journey. After being instrumental in handling complexities of the branch, I feel motivated to participate and continue contributing the same way to the growth of the bank.”

- Young banker from batch 06 - Joined in 2014 - Promoted to Deputy Manager in 2017, Manager in 2019 and to Senior Manager in 2021

“The program was well structured and helped me enhance my skills and develop my personality. My experiences were unique like Live case studies on present customer dealing and problem solving. The environment of the academy was absolutely great, and apart from academics I participated in events like seminars, quizzes, group discussions”

- Young banker from batch 07 - Joined in 2015 - Promoted to Deputy Manager in 2017, Manager in 2019 and to Senior Manager in 2021

“ABYBP is a platform that allows you to get a deep knowledge of all the banking processes, guidelines etc. which helps one understand the day-to-day banking activities. My journey from campus to an Assistant Manager to Sr. Manager was amazing and it involved a lot of hard work and discipline.”

- Young banker from batch 02 - Joined in 2013

“My Journey in Axis so far has been great. Being from a engineering background the things I learned in the campus has helped me a lot in understanding financial documents. Each and everything that we learned in the campus has helped me grow in the organization. The Young Banker program has helped me in many ways - Sales Skill, Customer service, Customer interaction, Banks policy and products, Study of Financial documents”

- Young banker from batch 07 - Joined in 2015

“It was a great journey from campus to corporate banking. Thanks to our mentors during ABYB program, who made me future ready. With their guidance I was able to capitalize on my academic success into professional success”

- Young banker from batch 14 - Joined in 2020

“Axis Bank Young Banker program gives brilliant opportunity for students who want to grow their career in the banking industry. Axis Bank work culture is very pleasant, and it also helps an individual to learn and grow in his/her career journey”

- Young banker from batch 15 - Joined in 2020

FAQ'S

It is a 12-month program comprising of 4 months of on-campus training, 3 months of internship and 5 months of on-the-job training. Post the successful completion of the program (12-month period consisting of 4 month on-campus,3-month internship & 5 months OJT), the candidate will join Axis Bank in a Sales role that will constitute of selling banking & financial products to the bank’s existing & new customers.

- Graduates or Post Graduates from any stream with 50% and above in their FINAL year of graduation OR aggregate of 50% and above in all years of Graduation.

- Candidates in the Final Year of their Graduation/Post Graduation who have appeared for their examination & are awaiting results are also eligible for the program. However, Original Combined Marks Sheet & Original Provisional Degree Certificate/ Original Passing Certificate/Original Degree or Graduation certificate will have to be submitted on joining.

- Graduation Degree (10+2+3 patterns) is compulsory

- You are not eligible if your age is more than 35 years

- You have a relative working at Axis Bank in accordance to the relative hiring policy of the Bank. Moreover, if two relatives get selected for the program, candidate with lower assessment score will have to withdraw their application

- You have been subjected to any disciplinary proceedings by your previous employer(s) at any time

- You have ever been proceeded against or convicted under any criminal statutes or in a consumer forum

- You have arrears in your graduation which are not yet cleared

- Any legal action is pending or proposed to be initiated against you

- Complete online registration form and pay the registration fee of Rs 100

- Take the online assessment(s) – Level 1 (L1) & Level 2 (L2)

- Successful candidates who clear both the L1 & L2 assessments will receive a Selection Letter confirming that they have been selected for admission.

- Complete Fee Payment and report to campus at Bangalore

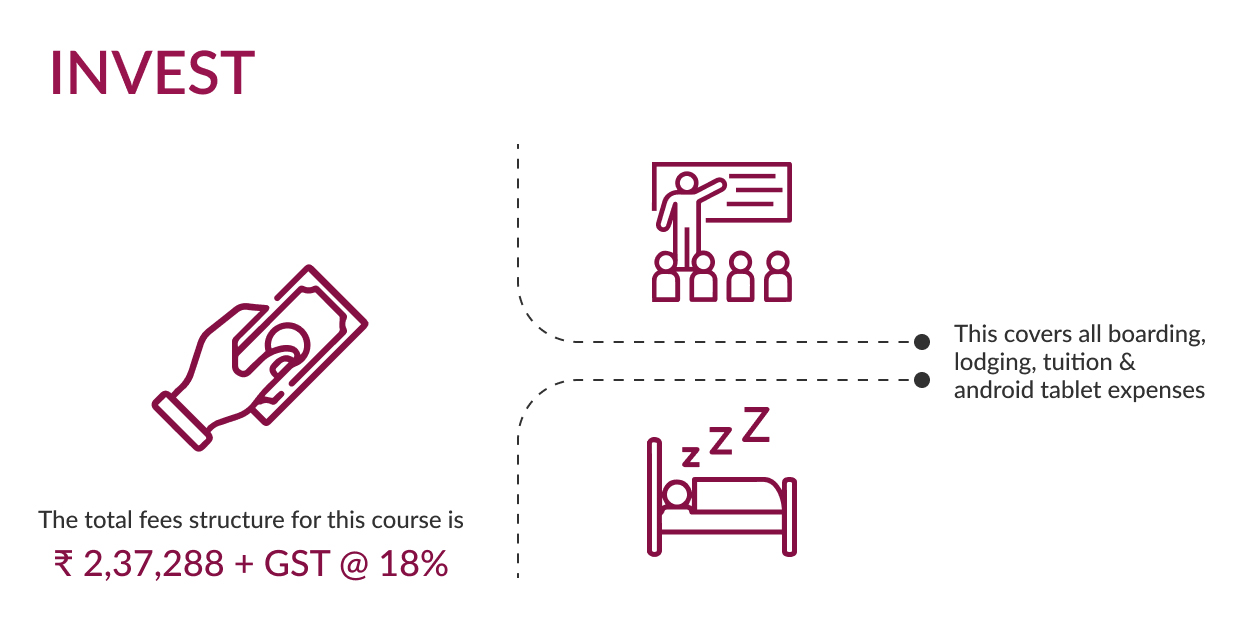

- The total Fee for the program is ₹2,37,288+18% GST (₹2,80,000 all inclusive).

- Prior to program commencement fees for Term 1 is payable - Rs 1,48,430.

- Term 2 fee of Rs 1,31,570 is payable 45 days after the program commences.

- This fee includes Tuition Fees, boarding & hostel fee, food expenses, Infrastructure usage, Health Insurance (Max Coverage of 1 Lakh Rupees),Tablet expenses & GST of Rs 42,713.

You can pay the fees from your own resources (Self fund) or you are welcome to take a loan from any bank of your choice or you may take a loan from Axis Bank. Loan shall be given subject to you fulfilling all requirements of the Bank.

Yes, you will get only one additional attempt in a given cycle for the ONLINE assessments.

Stage 1 : 4 months

- 4 months of classroom training at Manipal being Term I & Term II ( two months each )

- Successful completion of NISM Certification is mandatory during this period (Depository and Mutual Fund)

Stage 2 : 3 months being Term III

- Internship (you will be posted at any Axis Bank branch or office across India basis business requirement/vacancy)

- Only those who clear NISM examinations shall be eligible to begin their internship

- Completion of Internship Diary

- Evaluation by assigned Supervisor

Stage 3 : 5 months being Term IV

- Post successful completion of 4 months of classroom training and 3 month of internship, ABYB candidate becomes eligible to join as an employee, where initial 5 months are On-The-Job (OJT) training.

- OJT posting is the final posting (you will be posted at any Axis Bank branch or office across India basis business requirement/vacancy)

- OJT evaluation by Supervisor (for initial 5 months on the job)

- Milestone : On *successful completion of entire program (all 3 stages), become a certified Axis Bank’s Young Banker.

*”Successful“ means that Young banker has to clear all the exams/stage/certification by scoring the minimum marks at least, without which, the young banker will not proceed to next stage or join/become a confirmed employee at Axis Bank.

The selection process consists of 2-stages of proctored Online Assessments

- Level 1/ Written Test : Verbal Ability, Analytical Ability, Numerical Ability, Written English Test, Listening Comprehension Test

- Level 2/ Video Interview : Online AI Video Assessment

- Recent Passport size Photos

- Pan card & Adhaar card

- 10th Certificate

- 12th Certificate

- Degree documents (Degree Certificate and Grade report – consolidated / Term wise)

Yes, you will be awarded with a Post Graduate Diploma in Banking & Service from Manipal Academy of Higher Education (MAHE) post *successful completion of this program.

*”Successful “ means that Young banker has to clear all the exams/stage/certification by scoring the minimum marks at least, without which, the young banker will not proceed to next stage or join/become a confirmed employee at Axis Bank.

The final Job offer stands null and void if you do not complete the ABYBP program. The course fee will be non-refundable.

Please note that the course fee is paid towards the ABYB program to MAHE and not to Axis Bank for getting a guaranteed job. Also, note that no refund of the course fees will not be permissible under any circumstances if the candidate decides to leave after enrolment/during any stage of the program/post joining Axis Bank, as notified by MAHE.

To gain a better understanding of the life at campus, you may view the video on the home page.

Yes, you will receive Rs 5,000/- per month during first 4 months of campus engagement period at Bengaluru. Your salary will start from 5th month once you join the bank.

Post successful completion of the program you will be posted as an Assistant Manager in Axis Bank. The role offered will be a Sales role that will constitute of selling banking & financial products to the bank’s existing & new customers.

The annual CTC is Rs 4.42 lakhs. This includes an assumed annual performance-based bonus (Target variable pay) and includes eligibility-based loan benefits, insurance benefits and retirals like PF & Gratuity.

- Posting allocation during Internship and OJT (final posting) would solely depend upon business requirements of the Bank and vacancies available at that time

- While the Circle preferences may be asked, it does not guarantee posting in the preferred Circle

- An employee must serve for at least 2 years in their current role / location to be eligible for any role/location change.

- The above is applicable for all ABYBs across any role / vertical